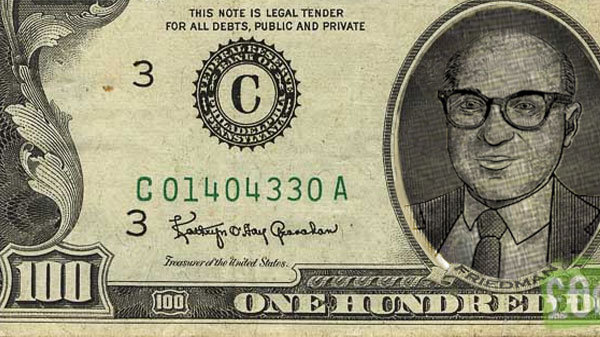

Winding down the Friedman Doctrine

5 December 2022

As the hundredth anniversary of the birth of Milton Friedman winds down, might the dogma of his doctrine finally wind down too? Or shall we continue to believe that greed is good, markets are sufficient, and governments are suspect?

Fifty-two years ago, Friedman published “A Freedman Doctrine: The social responsibility of business is to increase its profits” (in the New York Times Magazine, 13 September 1970; his book Capitalism and Freedom followed in 1962). Six years later, he won the so-called Nobel Prize in Economics.

Thirty years ago, I wrote a critique of this doctrine (published in my book Power In and Around Organizations). Time to try again. I excerpt from the original here, with minor editing, beginning with Friedman’s most famous passage.

… in a free society … “there is one and only one social responsibility of business―to use its resources and engage in activities designed to increase the profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.” (1970: 33, 126, quoting from 1962: 133)

Friedman referred to corporate social responsibility as a “fundamentally subversive doctrine” promoted by businesspeople who serve as " unwilling puppets of the intellectual forces that have been undermining the basis of a free society these past decades” (1970: 126,33). Arguably, that is what the Friedman doctrine itself has been doing for five decades, by offering an either/or choice between two ideologies: subversive socialism and free enterprise. In this world of black and white, there could be no middle ground. This doctrine was based on three questionable assumptions—technical, economic, and political.

Technical Assumption: The fallacy of shareholder control. Among the technical assumptions of this doctrine are (a) that shareholders will be willing to control the corporation formally, (b) that they, in fact, can, and (c) that such control will make a difference.

For quite some time, the trends in stock ownership seem to refute the first two assumptions. Many shareholders see their role as suppliers of capital in search of a stable return; if they do not find it in one place, then they simply move on to another. It has been easier to change their stock than the behavior of the large corporation. In effect, a free market does exist in stock ownership, and it serves to detach ownership from control.

As for formal shareholder control, specifically through the board of directors in the widely held corporation, most directors lack the time and information necessary to exercise close control of the management. At best, they name the chief executive, to whom they leave the making of specific decisions.

Economic Assumption: The fallacy of free markets. The second set of assumptions rests on the conventional views of economic theory. At the limit, this postulates the existence of free markets and full competition, unlimited entry, open information, consumer sovereignty, labor mobility, and so on. The debate over whether or not all of this is myth has raged long and hard, and both sides have scored points. Evidence can be found in industrial societies of both extremes, from the competitive grain merchant to the monopolistic power utility. One point, however, favors the skeptics: the larger the corporation, the more it can manipulate the market.

In 1776, Adam Smith wrote: “It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity, but to their self-love, and never talk to them of our own necessities but of their advantages” (1937: 14). One wonders what he would write today in the light of the immense size and market power of so many of the world’s largest corporations. How would Smith have responded to the massive use of advertising expenditures to restrict entry into an industry, and the forming of cartels?

We now have technologies that require massive investments to come online. We have governments granting huge contracts for defense equipment. In such cases, the thought of returning to arm’s length competitive markets―of corporations coming and going like Adam Smith’s brewers―while perhaps desirable, seems rather quaint.

As for the assumptions of the sovereignty of the consumer and the mobility of the worker, again something has gone wrong on the way to the market. Freidman asserted: “The political principle that underlines the market mechanism is unanimity. In an ideal free market resting on private property, no individual can coerce any other, all cooperation is voluntary, all parties to such cooperation benefit or they need not participate” (1970: 126). If only…

When the corporation knows more than its clients do, there is room for deception. A good deal of advertising can be described as manipulative in nature, that is, designed not to inform but to affect― to create emotional need or dependency. To the extent that this kind of advertising works―expressly as it is designed to― then to use Friedman’s terms, it coerces the consumer and evokes involuntary cooperation, thereby distorting consumer sovereignty.

As for the mobility of the worker, to argue that they cannot be coerced by the large hierarchical organization―that he or she can always change jobs―is a little bit like saying that if the tree does not like the soil where it is rooted, it is free to move on. The employee makes a financial and an emotional commitment to a community and a job—far more than the vast majority of the shareholders. He or she may have roots in a factory town, may have skills unique to the company. The decision to change jobs is hardly a casual one to the average employee. In an ironic twist of conventional economic theory, the worker is the one who typically stays put, thus rendering false the assumption of labor mobility, while the shareholder is the mobile one, thus spoiling the case for owner control.

Political Assumptions: The fallacy of isolated economic goals pursued by enterprises that are private. This final set of assumptions underlying Friedman’s position are also ideologic in nature, but more explicitly so. These are the essentially political assumptions that the corporation is amoral, society's instrument for providing goods and services, and more broadly, that a society is “free” and “democratic” so long as its leaders are elected by universal suffrage and do not interfere with the activities of business.

At the basis of Friedman’s argument is the assumption of a sharp distinction between social and economic goals, the one to be pursued by elected leaders, the other by private business people. This distinction ignores the reality in favor of tidy conceptualization. Social and economic consequences are inextricably intertwined in the strategic decisions of large corporations: hence many of these decisions cannot be described as amoral so much as the vehicles of an economic morality. In effect, Friedman ignored three fundamental arguments:

The first is that, in the world of corporate activity, means and ends interact. The corporation is not just a machine that ingests resources at one end and discharges products and services at the other with a certain level of efficiency. Along the way, all kinds of social events take place, with both positive and negative consequences for the society at large. Jobs get created and rivers get polluted, buildings get built and workers get injured, some individuals rise to their full potential and the talents of others get wasted.

Some of these social “externalities” can be measured in economic terms, with the result that the corporation can be penalized or induced financially to respond to society's wishes—if governments so wish, and are not held prisoners of corporate lobbying. But many cannot, and so society must find means that do not have to work through the profit mechanism.

The second criticism of the political assumptions focus not on specific behaviors of the single corporation but on the influence of the whole corporate collectivity. When Adam Smith wrote that the pursuit of self-interest promotes the “public interest,” he had something very special in mind, as did Friedman―society’s economic goals. Social goals were to be left to another sector. But to many critics, that neat division of labor has proved inequitable; the cards are stacked in favor of the private sector: the economic goals of society dominate the social ones.

The final political criticism is perhaps the most fundamental: Why the owners? If the power of the giant corporation is to be legitimized, why should it be concentrated in one group of influencers? Such control would only restrict the enormous benefits of corporate power to one already privileged group, and in the process reinforce society’s economic goals. Besides, property is not an absolute right in society: in a fundamental sense, the shareholders no more own the corporation than do the secretaries or the customers. Society's laws have defined one kind of ownership, and society’s institutions―judicial system, police forces, and so on― have protected it. That same society has every right to change the definition of ownership if it so chooses, to be more inclusive. Many of the laws pertaining to the giant corporation developed before it did. Maybe now is the time to make laws suited to the power it has attained.

Who, then, should control the corporation? Conventional economic theory sees ownership as the reward of endeavor. He who exerted the energy to build the empire should own it. That is an appealing argument, to reward success. But how about the builder’s progeny: Should they own the corporation because they happened to be born into the right family? How about the stock market operator who did something clever one day? Should one clever stunt in the stock market count for more than forty years of sweat in the foundry?

Increasingly, the debate over who should control the corporation is addressing fundamental questions of democracy. What is that word supposed to mean in a highly developed society? Should it be restricted to formal government, or broadened to encompass any institution that has significant influence on the citizens’ daily life? Should a society be called democratic if these citizens must spend one-third of their awake hours in institutions which are not democratic, in which they are “subordinates” to “superiors”, ultimately to a handful people at the “top” selected by like-minded people?

To conclude, the Friedman doctrine rests on some rather shaky assumptions. It seems quaint in a world of giant corporations, managed economies, and dispersed shareholders, not to mention one in which the collective power of the corporations is coming under increasing scrutiny, in which the distinction between economic and social goals is being readdressed, and in which fundamental questions are being raised about the role of the corporation in a society that claims to be democratic.

_______________________________________________

This is adapted from Chapter 33 of Power In and Around Organizations (pp. 632-644), in a section of the book called “Who Should Control the Corporation?” The book is out of print, but can be accessed free of change in PDF form. See also RebalancingSociety.org and Donald Trump is not the Problem.